7 Simple Techniques For Compare Car Insurance Quotes: Get Personalized Rates (2022)

Constantly examine with your insurance policy agent to obtain a quote on the insurance coverage prior to making an auto purchase. Insurance coverage needs to be figured right into your budget prior to purchasing a car.

An assessment exposed her old auto had a trade-in worth of around $4,000 (auto insurance). Jill wanted a 60-month car loan so she can keep both passion as well as monthly payments in check. She connected the trade-in worth and also wanted month-to-month repayment right into a calculator and also estimated that she can pay for a car that cost around $32,000.

After researching a few versions, Jill inspected with her automobile insurance coverage provider and also discovered the new vehicle insurance costs would set you back $80 a month. Spread over the life of the car funding, that would certainly have to do with $4,800, meaning a more sensible sticker label price was somewhere around $27,000 to meet her cost effective overall cost goal of $32,000. affordable.

In this post, we'll explore just how typical automobile insurance policy rates by age as well as state can fluctuate. Whenever you go shopping for vehicle insurance, we recommend getting quotes from numerous companies so you can compare coverage and also prices.

So why do average automobile insurance rates by age vary so much? Basically, it's all about threat. According to the Centers for Illness Control and Avoidance (CDC), individuals in between the ages of 15 and https://storage.googleapis.com/wicker-park-chicago-il-car-insurance/wicker-park-chicago-il-car-insurance/index.html 19 represented 6. 5 percent of the population in 2017 however stood for 8 percent of the complete expense of cars and truck accident injuries.

What Does Car Insurance - Aaa Auto Insurance Quotes - Aaa Northern ... Mean?

The price data originates from the AAA Structure for Traffic Security, and it represents any mishap that was reported to the police. The average costs data comes from the Zebra's State of Automobile Insurance policy report. The rates are for plans with 50/100/50 obligation insurance coverage limits and a $500 insurance deductible for extensive and also crash coverage.

According to the National Freeway Website Traffic Security Management, 85-year-old men are 40 percent more probable to enter a crash than 75-year-old men. Checking out the table above, you can see that there is a straight relationship between the accident price for an age which age group's ordinary insurance policy costs.

Keep in mind, you may find far better rates through one more firm that does not have a particular pupil or elderly discount. Average Auto Insurance Rates As Well As Cheapest Company In Each State Because vehicle insurance coverage prices vary so a lot from state to state, the carrier that supplies the least expensive car insurance coverage in one state might not supply the cheapest insurance coverage in your state.

You'll additionally see the average cost of insurance policy in that state to assist you compare. The table also includes rates for Washington, D.C. These rate approximates relate to 35-year-old chauffeurs with good driving documents and also credit report. As you can see, typical vehicle insurance coverage prices differ widely by state. Idahoans pay the least for vehicle insurance coverage, while vehicle drivers in Michigan spend the large dollars for insurance coverage.

insured car car low cost cheaper

insured car car low cost cheaper

If you live in downtown Des Moines, your premium will possibly be even more than the state standard. On the other hand, if you live in upstate New york city, your car insurance coverage plan will likely set you back less than the state standard (perks). Within states, auto insurance coverage costs can differ widely city by city.

Indicators on Car Insurance Calculator: Estimate Coverages That Work For You You Need To Know

The state isn't one of the most pricey general. Minimum Protection Requirements A lot of states have monetary responsibility regulations that call for drivers to lug minimal automobile insurance policy protection. You can just do away with coverage in two states Virginia and also New Hampshire however you are still monetarily accountable for the damage that you create.

No-fault states consist of: What Various other Variables Influence Auto Insurance Coverage Fees? Your age as well as your house state aren't the only points that affect your rates - insurance affordable.

Some insurance companies might use affordable prices if you do not use your car a lot. Others offer usage-based insurance coverage that may save you cash. Insurance providers factor the possibility of a lorry being stolen or harmed in addition to the cost of that vehicle right into your costs. If your vehicle is one that has a probability of being stolen, you might need to pay even more for insurance.

In others, having bad credit scores might create the price of your insurance policy costs to increase considerably. Not every state allows insurance firms to utilize the gender detailed on your motorist's license as an establishing consider your premiums. Yet in ones that do, women vehicle drivers typically pay a little much less for insurance than male motorists.

Why Do Auto Insurance Coverage Rates Change? Looking at average vehicle insurance coverage rates by age and also state makes you question, what else influences rates?

The smart Trick of Monthly Car Payment Calculator - Allstate That Nobody is Discussing

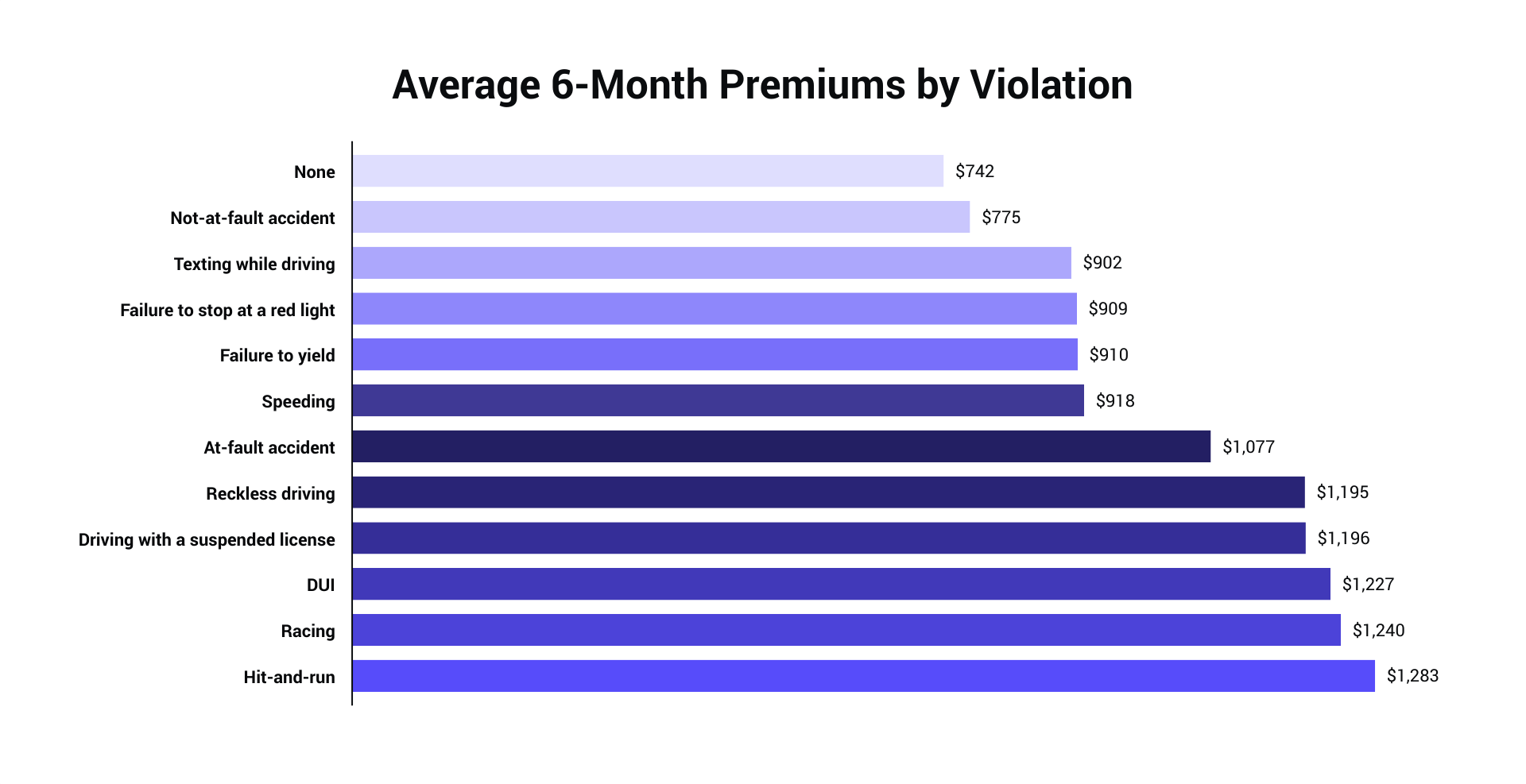

An at-fault crash can raise your price as much as 50 percent over the following three years. On the whole, vehicle insurance coverage has a tendency to obtain much more pricey as time goes on.

There are a number of various other price cuts that you may be able to capitalize on right currently. Right here are a few of them: Lots of business provide you the greatest discount rate for having a good driving history. Called bundling, you can obtain lower prices for holding more than one insurance policy with the same business.

Home owner: If you have a home, you can obtain a homeowner price cut from a number of providers - auto. Obtain a price cut for sticking to the exact same firm for numerous years. Here's a trick: You can always compare prices each term to see if you're obtaining the very best cost, despite your commitment discount.

insurers dui liability auto insurance

insurers dui liability auto insurance

Nevertheless, some can likewise elevate your prices if it transforms out you're not a great motorist. Some firms give you a price cut for having an excellent credit history. When browsing for a quote, it's a great suggestion to call the insurance firm and ask if there are any even more price cuts that relate to you - cars.

Connected: These 15 vehicles earned the highest safety ranking in 2018More recent design or prominent fave? Insurer carefully track information on vehicles to establish that makes and also models are a lot more susceptible to mechanical or safety and security problems. The longer an insurance provider guarantees a kind or version of vehicle, the a lot more data it needs to figure out reasonable prices.

Why Did My Car Insurance Go Up For No Reason? - Cover - Questions

Alternatively, automobiles with poor safety background, a short performance history, or those that are a preferred target for thieves will be more expensive to guarantee. Related: The one insurance policy add-on every brand-new automobile requiresCost of repair and maintenance, Information concerning the autos that are most inexpensive to keep and service can likewise be an excellent indicator of the most-affordable autos to insure.

What do I do now?Key variables associated with how you drive: As we discussed, it's not just concerning the car, however also the chauffeur. cheap car. Here are some key ways exactly how you drive can factor into insurance policy prices. Your motoring background, Your track document when driving can have a straight impact on your pocketbook when it concerns insurance coverage.

If you have actually had speeding tickets or crashes, or various other offenses within the last few years, your vehicle insurance coverage rate may be more than if you have a pristine driving document. Associated: Are you qualified for these 7 automobile insurance discounts?How much you drive, Are you a road warrior, or a homebody? The distinction will appear in your costs rates (cheaper car insurance).

cheap car vehicle insurance low-cost auto insurance cheapest auto insurance

cheap car vehicle insurance low-cost auto insurance cheapest auto insurance

It just makes sense, the even more time when traveling enhances the opportunities of being associated with a crash or suffering damages to your car. Related: Just how to maintain your high-mileage auto runningOther aspects to consider: Your credit report, Research study has actually revealed that excellent credit score is connected to good driving as well as vice versa - cheaper cars.

When permissible, several insurance business utilize credit rating to assist determine the price of vehicle insurance coverage. The bottom line: Good credit report can have a positive influence on the cost of your vehicle insurance coverage. Associated: 6 reasons you'll enjoy having an insurance representativeYour age, sex, and marital condition, Collision rates are higher for all vehicle drivers under age 25, especially solitary males.

How Car Insurance Coverage Calculator can Save You Time, Stress, and Money.

If you're a student, you may additionally be in line for a discount. The majority of auto insurers provide discount rates to student-drivers that take driver-safety training and begin constructing a risk-free driving record. Where you live, One crucial aspect that goes right into insurance coverage prices is largely out of your control a minimum of in the short-term - vehicle insurance.

Usually, because of higher prices of vandalism, theft, as well as accidents, chauffeurs in more densely inhabited areas might pay more for automobile insurance coverage. If you do stay in a higher price insurance area, ensure to pay close attention to the various other factors that you can manage. An ERIE agent can aid.

By doing some homework upfront about possible automobile insurance prices, you can make educated choices as well as better recognize why your prices increase or down. Better yet? You do not have to do it alone. Erie Insurance policy agents are right here to assist you recognize and also browse all the variables that influence your rates.

Very same safe vehicle driver, different roads, If you have a safe driving document with no speeding tickets or accidents, it's very easy to lament as well as wonder why did my automobile insurance policy go up? But if you relocated, that can be a telltale reason your insurance policy rates increased. If you relocate from a little community to a big city, there are naturally a lot more vehicles when driving and higher populace thickness.

For example, if there are slim, congested roads that are loaded with cars or there's a greater likelihood of auto burglary, your insurance rate might increase, Every one of that points to one point even more danger. So while your driving actions has remained the exact same, the roadways you're driving on have transformed as well as the added threat is mirrored in your insurance rates.

The Best Guide To Direct Auto Insurance

Very same vehicle driver, new vehicle, Maybe your driving has remained the same, yet you bought yourself a brand-new collection of wheels. Maybe you have actually spent lavishly on an electric lorry or a new convertible to live out your imagine doing not hesitate on the road. In this case, your brand-new automobile acquisition can be the perpetrator behind your greater prices - auto insurance.

While this is good for you, if it needs to be fixed in the future, it can be costlier for the insurance firm. Insurers have to get ready for that chance, therefore the greater insurance policy premium. Additionally, if you have an SUV or vehicle your vehicle might trigger more damage to other cars which might additionally boost your rate.

car insurance suvs insurance affordable cheap car insurance

car insurance suvs insurance affordable cheap car insurance

Any type of change you make to your automobile insurance plan can cause a price boost based on your threat profile. You got a discount, but you do not anymore, In particular circumstances, you might receive a discount rate as well as rack up a lower rate (cheaper cars). You might not understand that the rate you have actually is based on the discount rate and due to the fact that something in your life could have changed, you might no longer qualify for the price cut.

https://www.youtube.com/embed/g0lcv5LIIx0

, as well as each state has its own insurance coverage needs. In some cases there are certain points going on in your state that you have no control over that can influence your vehicle insurance policy rates. insurance.