AboutThe Best Guide To Who Pays For Your Auto Repair After A Car Accident That Wasn ...

If you win, you can get that cash back. For more information, call your county justice of the peace workplace. Find out more: What if my insurance coverage isn't paying enough?.

After getting the other chauffeur's vehicle insurance info, you drive house with no issue at all. You have no rental car protection on your policy, and you can't be without your car.

Before answering that concern, ask yourself the following: Do You Own The Car? In other words, is your car paid off completely?

Our Who Pays For My Car Repairs When The Crash Is Not My Fault? Diaries

If you take a cashout, your insurance business will pay you the difference of $400. If you pick to fix, your insurance might send out the check straight to the body store or to you.

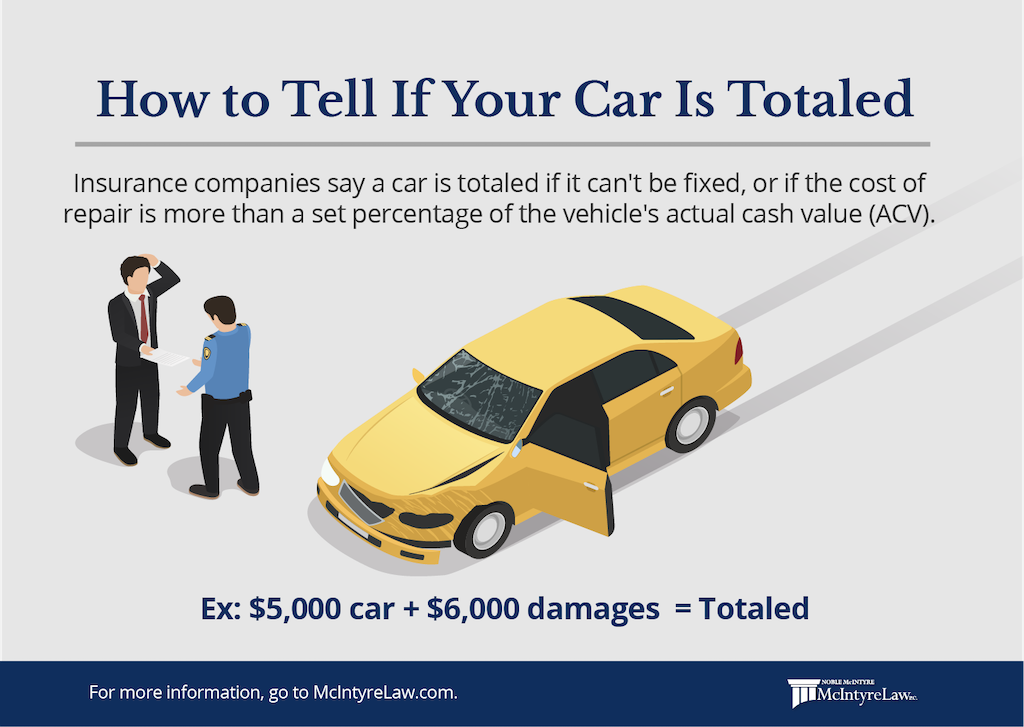

They are not needed to force you to fix your vehicle. You can use the money to repair it at your convenience or use it for something else. If your vehicle is a overall loss and you own it entirely, the very same treatments apply. Your insurance coverage company problems you a check for the value of your vehicle minus your deductible.

For motorists who are still making payments, their finance business will always be named on their insurance coverage policies. Investors still have an interest in the car and will desire it to be totally functional.

Paying For Repairs Without Going Through My Car Insurance for Beginners

Owning the vehicle provides you more flexibility in regards to your repair work alternatives, including whether to take a cashout and repair it at a later time, or not repair it at all. On the other hand, if you do not own the cars and truck, you will want to report your accident to your insurance company and repair it as soon as possible.

Yes, this suggests you can not afford to hesitate on your cars and truck repair work or utilize the money for something else. While exact reporting requirements and time restrictions can vary by insurance provider, you desire to function as quickly as possible. This means reporting your accident and suing as quickly as it happens.

You can submit online or phone. The initial claim report must take no more than 10 minutes. There is a Distinction In Between "Reporting" and "Opening a Claim" Reporting a claim suggests reporting the facts of the mishap to your insurance provider. On the other hand, "opening a claim" means that you plan to use among your policy protections to spend for property damage, physical injury, or something else like rental or towing.

Our After An Accident - Minnesota.gov Statements

As a general rule, however, you must report a mishap no more than 24 hours after the occurrence. Time constraints on utilizing your policy coverage can likewise differ by the insurance policy. If you report your mishap on time, you will be designated a claims adjuster who will be able to respond to particular questions about your claim, and any time restrictions you may have.

You still need to report the loss to them. If you plan to use your insurance for any protection, whether it's to have your lorry fixed or pay for someone else's damages, you want to act quickly. The quantity of time it takes to manage every claim concern, including the repair process, can be lengthy.

Have Questions or Dream to Arrange a Consultation? Call Us:-LRB- 626) 457-9114 or Send Out United States a Message.

Fascination About How Do I Get A Rental Car After My Car Accident In Ga? - Butler ...

If you read this post, you might have gotten into a vehicle accident recentlyor you know somebody who did. We hope no one was seriously injured. Secondand we hate to give you more bad newsthere's a possibility that even if you weren't hurt at the scene, you might feel some pain in your pocket the next time your automobile insurance coverage is up for renewal.

Once again, there's a chance your premium will remain exactly the very same., a non-profit devoted to assisting the public comprehend how insurance works.

Exactly how much more you'll have to pay differs from business to company and depends on the seriousness of the accident. If you are at fault and somebody is injured, you will probably lose your good chauffeur discount rate and could see a 20 to 25% premium boost, These boosts typically remain on your premium for 3 years.

Some Of Know Your Repair Rights - Collision Claim Associates, Inc.

Here's some recommendations on how you can put the brakes on any premium increases after you've been associated with a vehicle accident. Repair work costs and medical bills aren't the only financial blows that can follow you are associated with an accident. You might find that your vehicle insurance coverage rates increase also, as much as 32%, even if you weren't discovered at fault.

Since individual automobile insurance coverage rates vary, based upon elements like driving history and age, it is difficult to state precisely how much more you can anticipate to pay. If you have actually been associated with other mishaps, you can practically wager that your insurance will increase more than someone who has never had an accident before.

This gets rid of the tension of getting an unexpectedly high bill in the mail and gives you, and your budget plan, time to adjust. 1. Inform your insurance company about the accident, no matter how little it was If you caused a minor mishap in which nobody was harmed, or you weren't at fault, you might be tempted to just not tell your insurance provider about it.

Excitement About Getting “Car Repair Bills” Paid After A Car Accident - Shouse ...

Due to the fact that some insurance companies have actually accepted that mishaps are merely a part of life, they want to neglect your very first accident and not raise your premium. "The information differ by business," says Worters. "Some might give you accident forgiveness right away, while others will only do so after you've been an accident-free policyholder for as many as three to 5 years.

"However otherwise, it may help in reducing rates. Don't wait for your insurance provider to ask you to do this. Do it by yourself and inform them about it." You can find a chauffeur's ed refresher course in your state here. Premiums vary substantially from company to business. If you have house insurance coverage through another company, include it on your list of potential car insurance companies.

https://www.youtube.com/embed/CI_mFIfFars

Can you get automobile insurance after an accident? You can still start car insurance coverage to cover future events after you have actually had an accident.